vermont sales tax on alcohol

There is no applicable county tax or special tax. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

Discover 14 Of The Most Fun And Interesting Facts On Vermont Economic Ones Too

This means that an individual in the state of Vermont purchases school supplies and books for their children.

. Download all Vermont sales tax rates by zip code. Download all Vermont sales tax rates by zip code. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities.

Vermont Cigarette and Fuel Excise Taxes. Excise taxes on Fuel are implemented by every state as are excises on alcohol and tobacco products. Pay directly to the Commissioner of Taxes the amount of tax on the vinousmalt beverages shipped.

Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. All alcoholic beverages are subject to sales taxes. The statewide rate is 56.

The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. Download all Vermont sales tax.

Certain Municipalities may also impose a local option tax on meals and rooms. The Brandon Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Brandon local sales taxesThe local sales tax consists of a 100 city sales tax. Thus the sales tax on alcohol can be as high as 121.

All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. Higher sales tax than 87 of Vermont localities. Remy VSOPAuthentic Brandy 175L 2399 2599 80 041 067319 Villon Cognac 750ML 3899 3699 200 80 146 Cocktails.

This means that depending on your location within Vermont the total tax you pay can be significantly higher than the 6 state sales tax. Direct Ship to Retail. Remy VSOP French Brandy 750ML 1599 1399 80 063 050688 St.

Washington has the highest spirits tax in the United States at 3322 per gallon. This is over 10 more than the second-highest tax in the state of Oregon at 2195. The tax on beer is 23 cents and on wine its 75 cents.

10 on-premise sales tax. The Burlington Sales Tax is collected by the merchant on all qualifying sales made within Burlington. Are suitable for human consumption and.

100 on sales of alcoholic beverages served in restaurants. Malt and Vinous Beverage Tax 7 VSA. The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol.

Vermont 802Spirits Current Complete Price List April 2022 Code Brand Size VT Reg Price NH Price VT Sale Price Save Proof Price per OZ 050686 St. The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine. This introduction includes instructions on how.

By Anne Wallace AllenVTDigger. In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Vermont and Federal levels. The sales tax rate is 6.

The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction. Vermont Liquor Tax 15th highest liquor tax. Vermonts general sales tax of 6 also applies to the purchase of beer.

Vermont has several excise taxes and local taxes in addition to the sales and use taxes. Delivery in Vermont by the holder of a license shall be deemed to constitute a sale in Vermont at the place of delivery and shall be subject to all excise and sales taxes levied by the State of Vermont. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that.

Vermont has state sales tax of 6. The Burlington Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Burlington local sales taxesThe local sales tax consists of a 100 city sales tax. Effective June 1 1989.

The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax. -88817841970013E-16 lower than the maximum sales tax in VT. In Vermont beer vendors are responsible for paying a state excise tax of 026 per gallon plus Federal excise taxes for all beer sold.

See definition at 32 VSA. Sales and Use Tax. In addition the county rate may be up to 20 and the city rate up to 45.

90 on sales of lodging and meeting rooms in hotels. See definition at 32 VSA. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax.

The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax. Vermont has a 6 statewide sales tax rate but also has 153 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0156 on top of the state tax. You can print a 7 sales tax table here.

The state of Arkanas adds an excise tax of 250 per gallon on spirits. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. 421 Tax is imposed 1 on sales from bottlers and wholesalers to retailers and 2 retail sales by manufacturers and rectifiers.

Both states gain enough revenue directly from alcohol sales through government-run stores and have set prices low enough to be comparable to buying spirits without taxes. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. The Brandon Sales Tax is collected by the merchant on all qualifying sales made within Brandon.

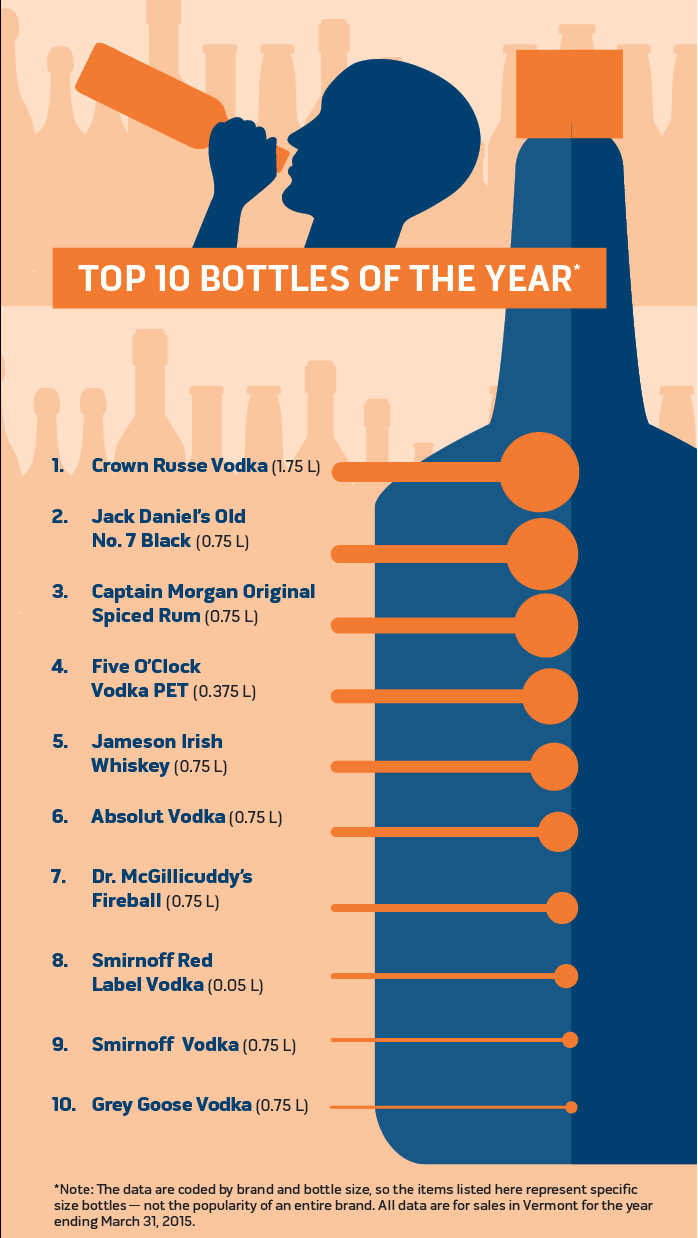

When it comes to liquor purchases made in the first weeks of quarantine Vermonters went for quantity over quality buying more 175-liter bottles of inexpensive brands and less of the artisanal spirits that have defined their purchasing habits in the past. Sales and use tax for sales of goods. For beverages sold by holders of 1st or 3rd class liquor licenses.

While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected. Sales of alcoholic beverages that. In addition to the sales tax rate of 6 percent consumers must pay a 6-percent use tax if they purchase taxable tangible personal property without paying the.

Alcoholic Beverage Sales Tax. Vermont Beer Tax - 026 gallon. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Vermonts excise tax on Spirits is ranked 15 out of the 50 states.

The tax rate is 265 cents per gallon of malt beverage containing 6 or less alcohol by volume and 55 cents per gallon for all other malt beverages and for vinous beverages. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. Liquor sales from state stores increased by 14 in March over the same month last.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. 90 on sales of prepared and restaurant meals. Tax Rates for Meals Lodging and Alcohol.

Over 6 alcohol 055.

New State Laws On Sexual Consent Health Care And Alcohol Sales Take Effect July 1 Vtdigger

Vermont Cigarette And Tobacco Taxes For 2022

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Whistlepig Farm 15 Year Old Straight Rye Whiskey Vermont Prices Stores Tasting Notes Market Data

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Adirondack House House Home House Plans

Vermont Income Tax Vt State Tax Calculator Community Tax

Historical Vermont Tax Policy Information Ballotpedia

Vermont Income Tax Vt State Tax Calculator Community Tax

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

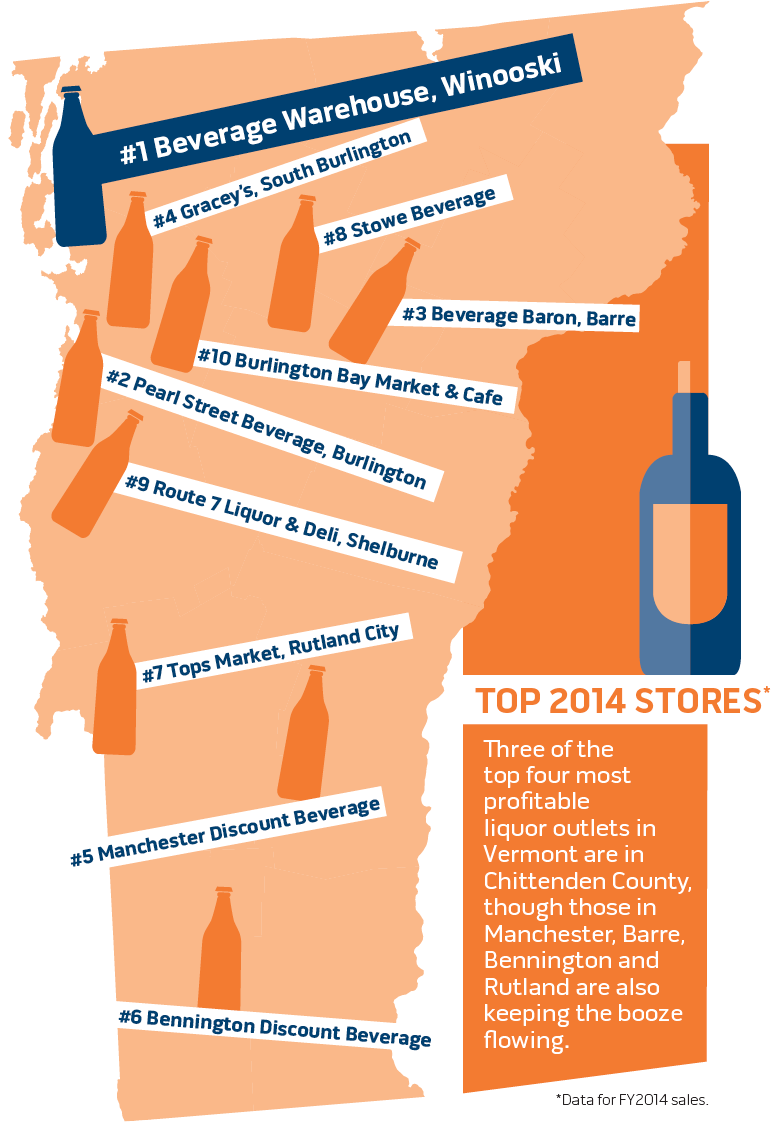

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Gold Vodka Prices Stores Tasting Notes Market Data

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice