december child tax credit check

000 551. 15 others might receive up to 1800 which is.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

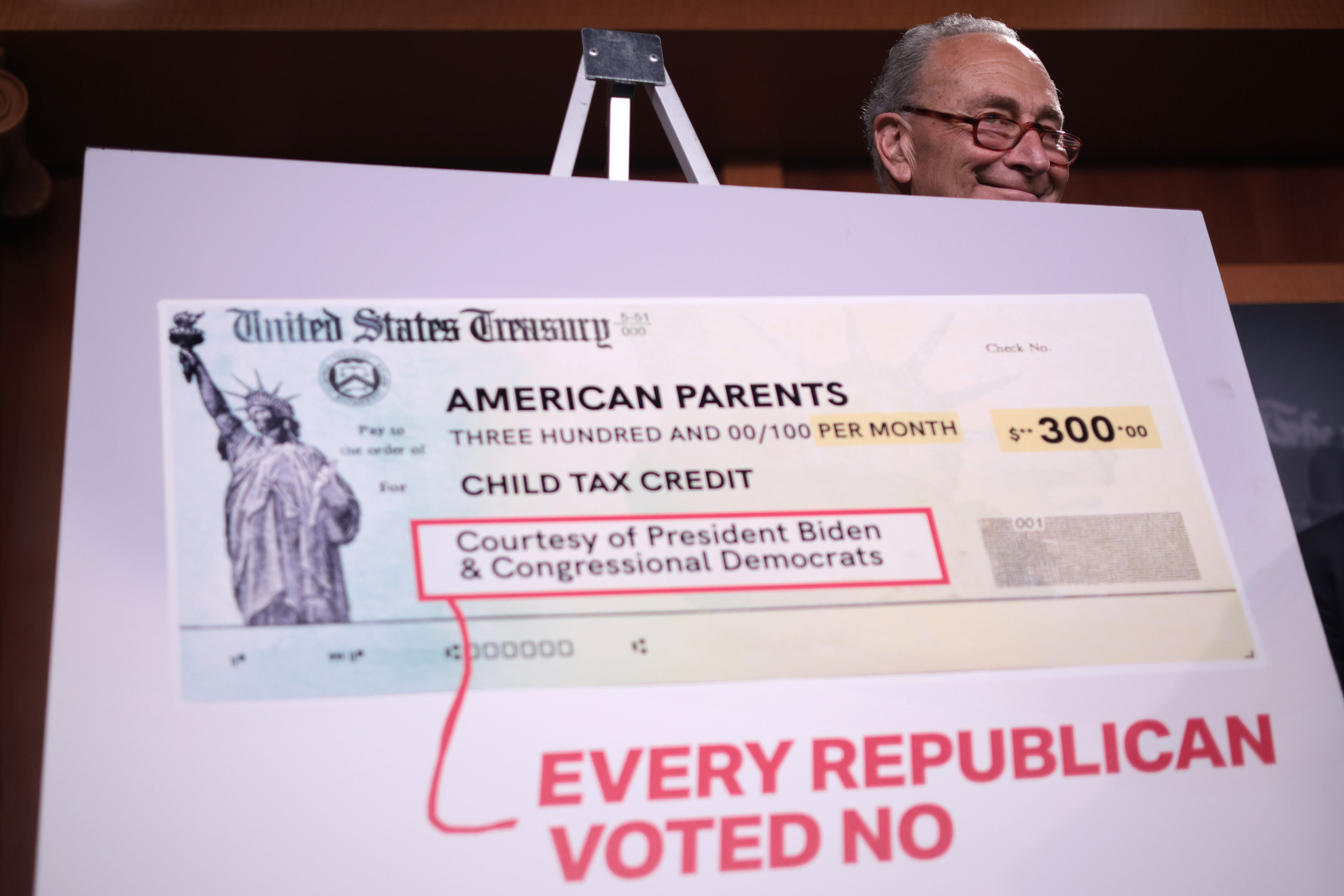

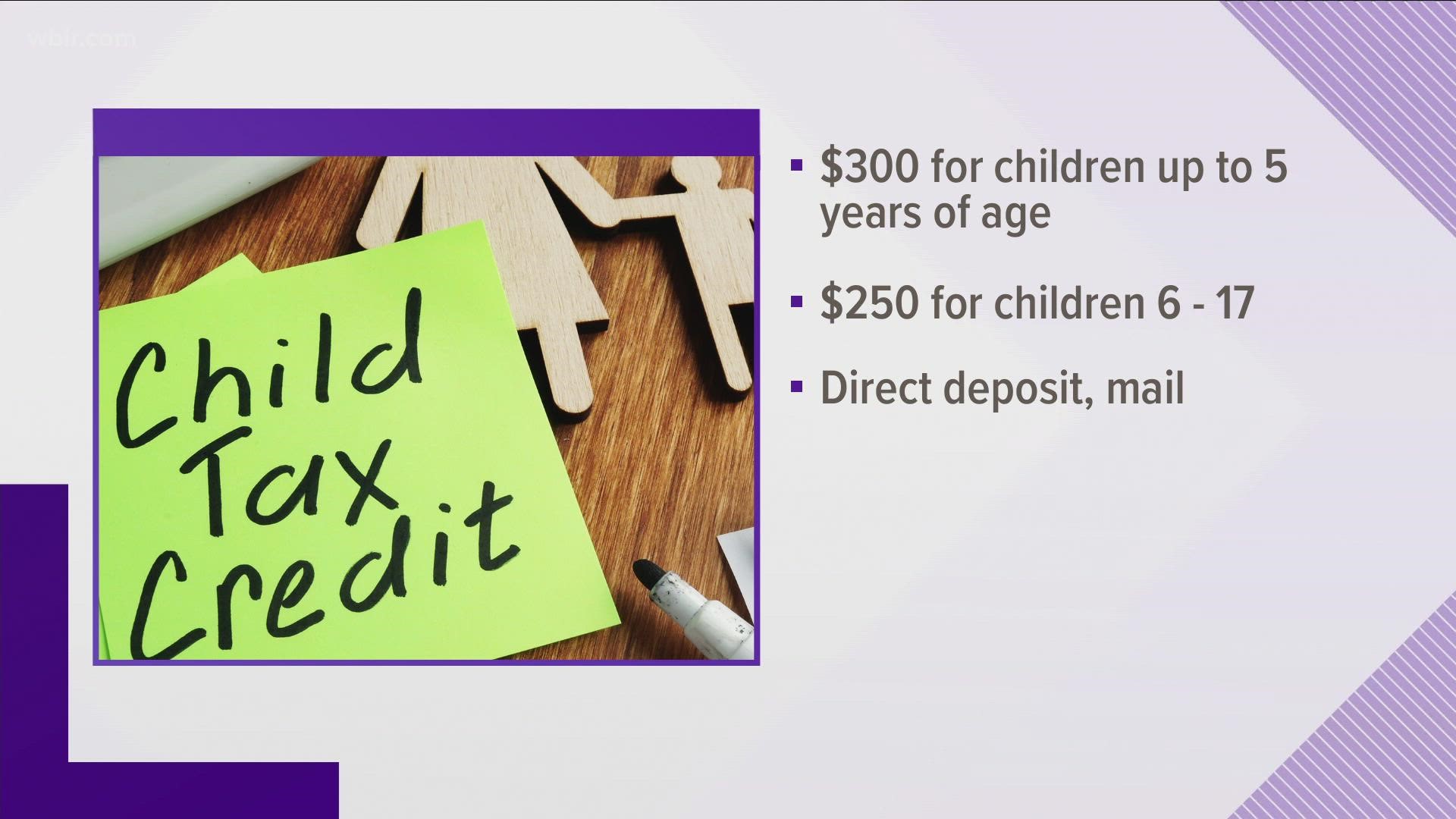

Initially families received the child tax credit monthly payments of 300 or 250 from July to December 2021.

. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The enhanced child tax credit has been highlighted as one of the provisions of the Tax Cuts and Jobs Act designed to lower overall tax liability for middle-class families. The Tax Cuts and Jobs Act TCJA the tax reform legislation passed in December 2017 doubled the maximum Child Tax Credit boosted income limits to be able to claim the.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. When this happens the child tax credit may be refundable to the benefit of the taxpayer. Eligible families who did not opt out of the monthly payments.

How to opt in. Americans who qualify for enhanced Child Tax Credit benefits might be getting their final advance payments this week as the program is slated to wrap up on Dec. That total changes to.

While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. As the income level grows the amount a taxpayer qualifies for is gradually reduced. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. The December check will arrive through direct deposit for millions of parents on Dec. It also provided monthly payments from July of 2021.

Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible. When does the December child tax credit payment arrive. For parents of young children up to age five the IRS will pay 3600 per child.

You should look for the. While many taxpayers can expect to receive either 300 or 250 per child depending on their childrens age on Dec. Half of it will come as six monthly payments and half as a 2021 tax credit.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. To reconcile advance payments on your 2021 return. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. 8 rows The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child. When does the Child Tax Credit arrive in December. Eligible families who did not opt out of the monthly payments are receiving 300.

The rest of the 3600 and 3000 amounts should have been. The amount parents receive depends on the age of the child. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis.

Families caring for children. The 7 Child Tax. The enhanced child tax credit will total 3000 per child ages 6 through 17 and 3600 per child 5 and under.

7 rows The IRS has not announced a separate phone number for child tax credit questions but the main.

Scam Alert Child Tax Credit Is Automatic No Need To Apply Oregonlive Com

Why Is There No Child Tax Credit Check This Month Wusa9 Com

Missing A Child Tax Credit Payment Here S How To Track It Cnet

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

Child Tax Credit Is December The Final Check Deseret News

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

The December Child Tax Credit Payment May Be The Last

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Missing A Child Tax Credit Payment Here S How To Track It Cnet

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News